- $DOWN Debrief

- Posts

- 11/11/22

11/11/22

What a week huh?

Uh... is this real life?

Firstly, sorry to do this; but I think we lose our crypto bro membership if we don't mention something about FTX and SBF? So here it is - there's so much talk about the FTX meltdown that no one seems to have noticed Andre Cronje quietly re-enter the ranks of the rekt. Which we aren't going to deep-dive, and who really knows what the market will do next amirite?

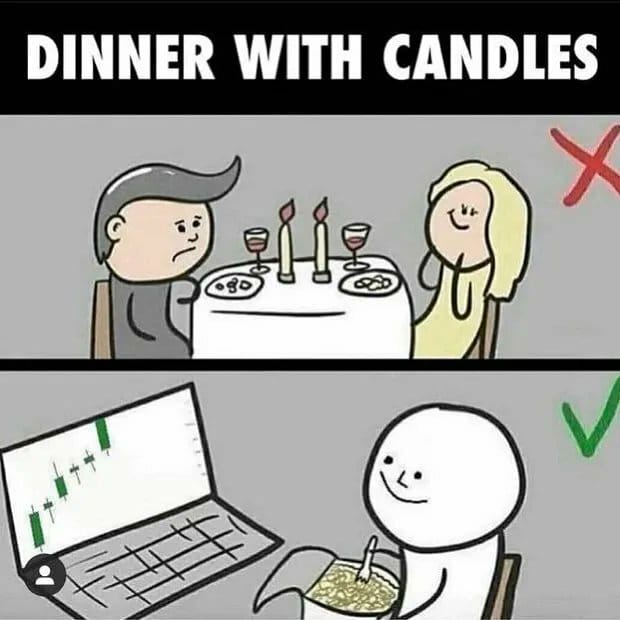

So anyway, you want good news, not more differently-worded email blasts about the same topic. Well, let's see what we've got, quicknotes style. But first, a meme, that's not about FTX, or SBF. Ok, that's our mentions quota, all set.

- US inflation data reported today showed a decrease of inflation rates from 8.3% to about 7.1% - On the back of that news, the President flexed his economics plan as working as intended, and implied the fed might pivot sooner than expected if inflation reduction continues. - [maybe not entirely good, but likely a good sign.] The UN (ya that one) issued a warning to the US government related to the aggressive hawkishness of the federal reserve and insisting they alter their strategy to combat inflation for the sake of the world economy.- The above-mentioned inflation rates resulted in a significant rise in activity and value all across the stock market(s?), with as much as a 7.5% overall valuation growth of the DJI- Most often, a stock market rally means that the 'big dog' investors are also more likely to create more demand for digital assets.

So how has $DOWN fared along the rolleroaster of a week we'd already had by Tuesday? Realistically, there weren't any huge price swings in either direction. If you look at the following data; with thanks to Nomics for making the data we were looking for readily available, there is of course a reaction to the week's hijinx, but it's pretty tolerable by comparison.

Another positive effect, or at the least a silver lining, is found in the high trade volume of most of the market as people did their best damage control. To the point, $DOWN's primary liquidity pool is made up of DOWN/ETH/MATIC, using Balancer. Thanks to the way Balancers liquidity protocol functions, our current largest liquidity source is (albeit quite slowly at present) accumulating collected fees from eth/matic trades or trades routed using the same. The more significant feature of which, is the one/two sided increase in eth, matic or both; but not $DOWN, meaning more value provided per $DOWN token. ;)To improve the potential for $DOWN to benefit from the current, and certainly the coming volatility; we'll be applying the same logic to $DOWN paired with 2-3 popular stablecoins; coupled with a yield rewards program focused on $DOWN/stables LP. The goal is to provide the opportunity to both benefit the $DOWN token by way of liquidity and reduction of volatility; and to earn an appealing return on assets unphased (mostly) by the 2022 shit tsunami that's raging through crypto land.

We've got a lot of other big things in the pipeline, but, as was pointed out to me somewhat recently (rather cruelly might I add, since I'm now acutely aware of it) I 'work in circles'. Meaning there's a lot of things referred to as planned or upcoming, because instead of one thing after another like a normal person, they're being built in parralel. But on the positive side, that means they'll all be deployed in a "rapid-fire" manner, since they'll all be getting finished around the same time. It's likely to be rather quiet in our corner of the webosphere for a time, but that just means that we'll get to know the real degens, and the giga-brain innovatooors who stick around. Plus, $DOWN can shine based on its genuine merit, as opposed to rampant speculation and rapid loss of interest when new tokens launch during "up only season" and are easily pumped for quick gains.

On a personal note; if you're wondering why this installment of our newsletter seems largely void of any new developments or updates to upcoming sectors of the $DOWN ecosystem; it's primarily due to my apartment having no electricity for nearly an entire week. So, as one might imagine, I'd not had much, if any, access to wi-fi, my computer, or even my phone. But, for the time being, nearly all of my apartment has electric and there will be more progress to share next week.